July 2, 2025

Golden Anniversary Promo

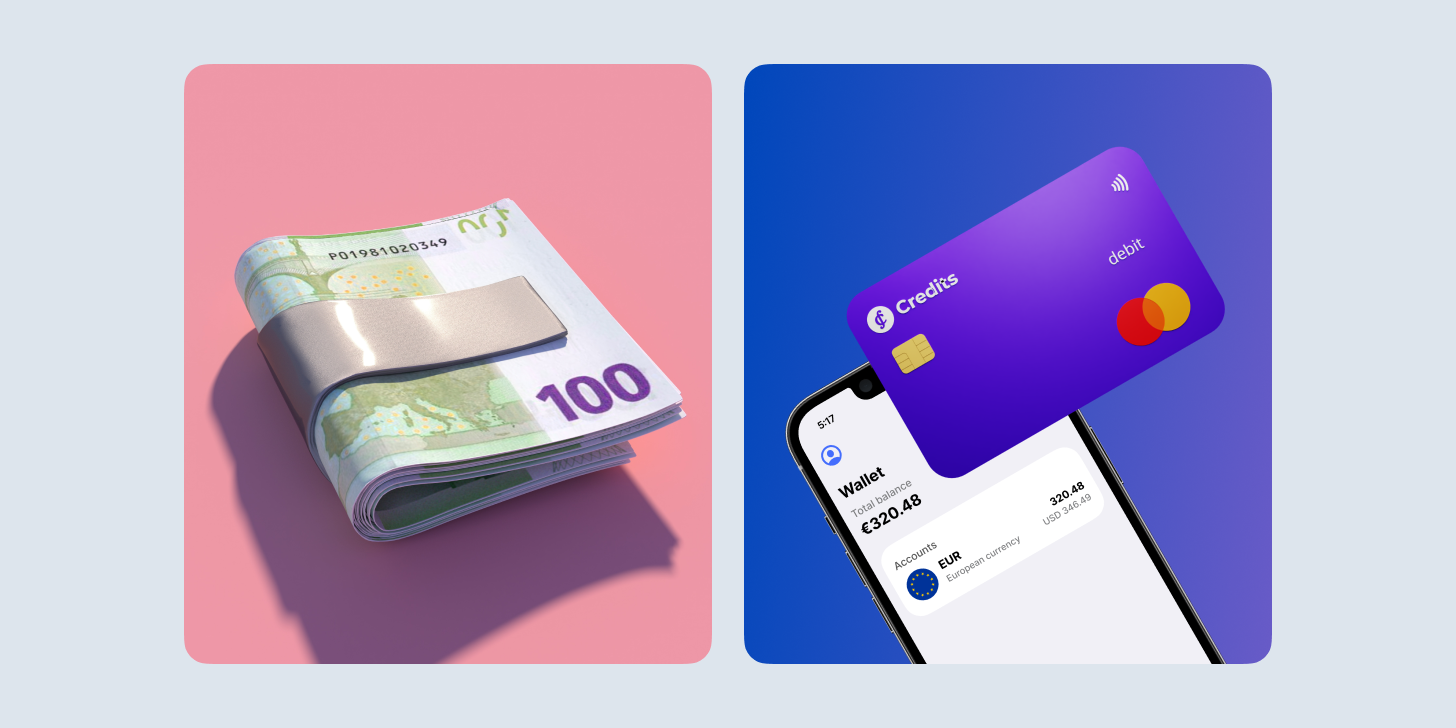

Money makes the world go round—but how we use it has drastically changed. Some people still prefer the reliability of cash, while others embrace the speed and convenience of digital money. With financial technology evolving rapidly, the question remains: Are you #TeamCash or #TeamDigitalMoney?

Team Cash: The Classic Choice

Despite the rise of digital payments, cash remains a strong contender for several reasons:

✅ Universal Acceptance – No need to worry about card machines or internet access.

✅ Better Budgeting – Physically handing over money makes you more mindful of spending.

✅ Privacy & Security – No digital footprints or cyber fraud risks.

✅ No Transaction Fees – Unlike some digital payments, cash transactions don’t come with hidden costs.

However, cash can be inconvenient to carry and is vulnerable to theft or loss.

The rise of e-wallets, mobile banking, and cryptocurrencies has made digital transactions more popular than ever:

💳 Convenience & Speed – Tap, scan, or transfer with just a few clicks.

💳 Better Financial Tracking – Apps provide transaction histories for easier budgeting.

💳 Safer & More Hygienic – No need to handle physical bills, reducing the spread of germs.

💳 Global Access – Make purchases and send money anywhere without cash conversion hassles.

Despite these advantages, digital payments can be affected by system downtime, fraud risks, and dependency on technology.

Rather than choosing one side, many people mix both methods. Cash is still king in emergencies, but digital money dominates modern transactions. The real question is: Which side do you lean toward more?

🔹 Are you #TeamCash for its reliability and privacy?

🔹 Or are you #TeamDigitalMoney for its speed and ease

No matter what you choose, it's always best to spend your money wisely.